Cryptocurrency has been a hot topic and attracts mixed reactions depending on the individual experiences of the person you talk to. Some people attach so much praise and admiration to crypto while others remain skeptical. One thing about crypto, altcoins particularly, is that their prices keep fluctuating every other day. For instance, just recently Ether dropped 15% which tells of how these currencies may be unpredictable.

While altcoins undergo periodic volatility, some may be such consistent falls that sends shivers down the spine of investors. Nobody wants to watch their Ether, Tether, Dogecoin or whichever altcoin holding shed so much value and just sit pretty as if nothing bad is happening. An average investor must be ready to act and respond to realities as they present themselves. We here try to share nuggets on what may save altcoins investors from losing their much valued fortunes.

Groundwork about Cryptocurrencies in General and Altcoins in Particular

In the current age where people are getting more interested in and aware of existing digital investment options, crypto has been a top consideration. Those interested in details about crypto will focus on an aspect such as the rise and fall of cryptocurrencies-what fintechies would call crypto volatility.

Honestly, crypto has been a learning experience for all. Nobody, not even legendary investors can confidently claim full know;edge of these virtual coins. Everyday, new information and trends keep emerging but still, nobody can deny that the coins have created dollar millionaires and continue to be a great investment option globally. Ideally, nobody knows about the future of cryptocurrencies. You must have heard people speculating about the future of cryptocurrencies and perhaps how cryptos are likely to dominate the world in the coming years. Truth be told, all these are mere hearsays which are based on conjecture and probabilities. If there is one word that can provide a description of cryptocurrencies, it’s volatile.

Currently, the majority of investors think that the biggest challenge is yet to occur even though the evident signs are leaning far from that perception. On the other hand, there is another faction that believes that cryptocurrencies are nothing short of the millennial fascinations, and another bubble. Either way, the rise and fall of cryptocurrencies prices are dominating the world.

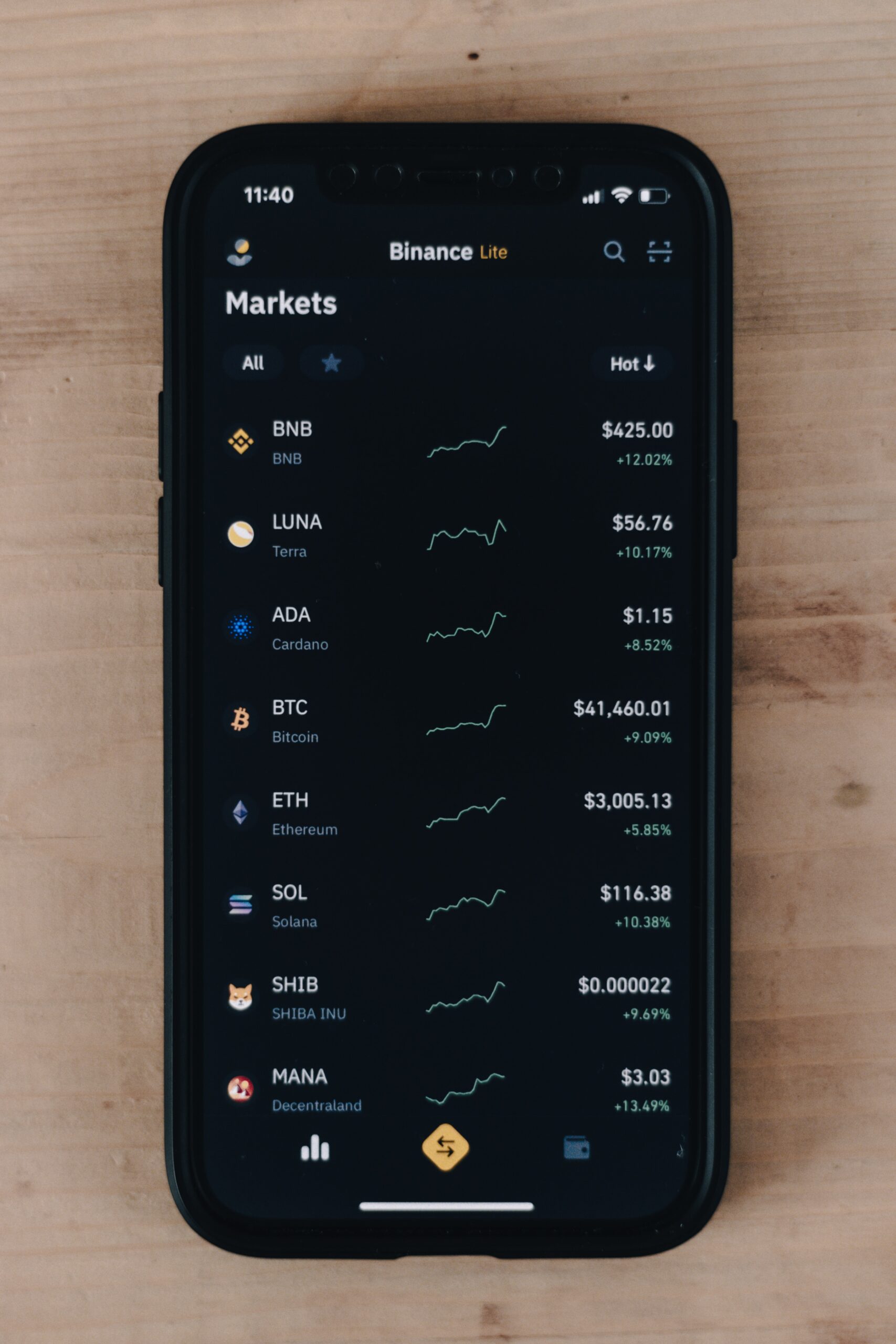

Many people also realized that altcoins (alternative coins) such as Ripple, Ethereum, Monero, and Litecoin have continued to demonstrate potentiality in terms of growth. In fact, about the top 30 of the cryptocurrencies are altcoins, which boasts nearly billions in the market cap.

Despite all these, many altcoins have fallen even further in recent months in what has already been a difficult year for people within the crypto space. The prices have kept on plummeting, rendering huge losses to investors. As an investor, therefore, you should know some of the clever moves to avoid losses particularly when the prices fall.

Here is what you may need to do and save your altcoins from a chilling shed off of value

We must admit that our recommendations are not perfect or a near match to what may exactly fit your situation. All we do is share insights that have worked elsewhere to at least provide every budding crypto investor with possible ways to work around glaring threats of losses. One or multiple of these recommendations may just be enough to solve your situation. So, you will need to do extra work and sift through this list and any other possibilities not listed here to navigate a market characterized by altcoins shedding off value.

1. Stay calm while keeping a Long-term Perspective

Financial losses come with a lot of emotions and shocks. Although emotionality is a common thing within the cryptocurrency space, it is important to stay calm when the prices plummet. Whether you want to make a decision to sell a cryptocurrency or see it as an opportunity to acquire more, it is important to remain calm and vigilant. If you try making an emotional decision especially when trading in your altcoins, it will result in nothing good but loss.

Bearing in mind that cryptocurrency investment is generally volatile, you need to zoom out and look beyond today. The ups and downs are completely normal within the market cycles and can be more extreme with new and emerging altcoins. Provided that you have not invested money that you need to use in the short term, you may afford to wait until the prices rise. As such, you need to reflect on your overall trading objectives and financial goals before doing anything while panicking.

2. HODL your altcoins if possible

One of the common jungle rules that applies here is that only the smart investors survive within the cryptocurrency ecosystem. Here, you are required to stay vigilant to benefit from any information that might be prevailing within the cryptocurrency market. Ideally, it is possible that at an event of any price fall, you will be able to get information about the factors contributing to the price fall and recommendations available from other investors. Hodling means keeping your coins and then selling them only after the market has recovered and prices have risen. Let’s imagine that you see the price of Bitcoin fall by 20% and sell your holdings. What happens if the price suddenly rises back to its original value? It means that you have obviously lost 20% of your money.

3. Consider buying a dip

In the business world, it is common for people to buy during the lows and selling during the highs. It is not really easy to time the market in this way. However, a number of opportunities may occur and this will give you a chance to pick up your favourite altcoins at low price. You can also consider preparing your finances for use when there is a sudden drop in the cryptocurrency market. Attempting to hold your funds longer will be an excellent move to handle the plummeting prices of the altcoins.

4. Embrace Diversity

It is always good to remain afloat even when the altcoins prices fall. It is extremely a good idea to understand the reasons why the prices fall. Needless to say, a dip in prices will without a doubt impact your entire portfolio. If the rationale for your investments still holds water and you think you need to continue investing, well and good. However, we advise diversification when the prices fall. Diversification in this case means avoiding putting all your investments within the cryptocurrency space, unless you are more into gambling. We recommend that you only invest a portion of your larger investments into altcoins. There are plenty of other safer investment options or to earn profits without trading. In this sense, try to strike a balance to your exposure. To do this, keep a good proportion of your fortunes in stuff such as real estate, stocks, and ETFs. This means that in any case the current dip is the start of the huge impending crash. So, the solace is that you won’t be subjected to a financial loss.

The Bottom Line

The fall of altcoins prices is an integral component of this investment. Should this be your first encounter with the plummeting values, relax until the prices recover. It is also advisable to take some break outside the crypto ecosystem before you start trading again. You can also check out our other article to learn more on what it takes to go through seasons of cryptocurrency meltdowns.